In recent years, the world of investing has undergone a significant transformation. The rise of technology and the democratization of financial services have led to the emergence of robo-advisory platforms, which have made it easier for individuals to invest their money in a more informed and strategic manner. Robo-advisors leverage algorithms, financial theories, and user inputs to create personalized investment portfolios that align with the investor’s goals, risk tolerance, and time horizon. One such firm leading the charge in this space is Stalwart Holdings, which has developed an investment portfolio service rooted in academic research and cutting-edge financial principles. This article explores the concept of robo-advisory services, delves into how a personalized investment portfolio can be built using Modern Portfolio Theory (MPT), and highlights the innovative approach taken by Stalwart Holdings.

Robo-advisors are automated platforms that provide financial advice or investment management with minimal human intervention. They utilize algorithms and software to build and manage client portfolios based on the individual’s financial goals and risk tolerance. The appeal of robo-advisory services lies in their accessibility, affordability, and efficiency. Unlike traditional financial advisors who may charge high fees or require significant account minimums, robo-advisors often offer their services at a fraction of the cost and with lower barriers to entry. This has opened the door for a broader range of investors, from those just starting their investment journey to seasoned professionals seeking a more hands-off approach.

According to a report by Statista, the global robo-advisory market is projected to reach $2.55 trillion in assets under management by 2023, reflecting the growing trust and reliance on these platforms. The rapid adoption of robo-advisors can be attributed to their ability to harness sophisticated financial theories, such as Modern Portfolio Theory, to construct diversified and risk-optimized portfolios.

Modern Portfolio Theory, developed by Nobel laureate Harry Markowitz in the 1950s, is a cornerstone of contemporary investment management. MPT is based on the idea that investors can construct an “efficient” portfolio—one that offers the maximum possible return for a given level of risk—by carefully selecting a mix of assets. The theory challenges the traditional notion that individual securities should be evaluated in isolation. Instead, MPT emphasizes the importance of diversification and the interrelationships between assets, arguing that a well-diversified portfolio can reduce overall risk without sacrificing returns.

To understand how MPT works in the context of model portfolio services, consider the key components of the theory. First, MPT assumes that investors are risk-averse, meaning they prefer to minimize risk while achieving their desired returns. It introduces the concept of the efficient frontier, a curve that represents the optimal portfolios that offer the highest expected return for a given level of risk. Portfolios that lie on the efficient frontier are considered optimal, while those below the curve are deemed suboptimal because they do not provide sufficient returns for the amount of risk taken.

To build a personalized investment portfolio using MPT, a robo-advisor would begin by assessing the investor’s risk tolerance, financial goals, and investment horizon. This is typically done through a questionnaire that evaluates factors such as the investor’s age, income, investment experience, and risk appetite. The robo-advisor then uses this information to determine an appropriate asset allocation strategy, which involves spreading investments across different asset classes, such as stocks, bonds, and cash equivalents, to achieve diversification.

Diversification is a fundamental principle of MPT. By investing in a variety of assets that are not perfectly correlated, the overall risk of the portfolio can be reduced. For example, when stocks decline in value, bonds or other assets may remain stable or even increase, helping to offset losses. The goal is to create a portfolio where the combined risk is lower than the sum of the individual risks of the assets.

Once the asset allocation strategy is determined, the robo-advisor uses optimization algorithms to construct a portfolio that lies on the efficient frontier. This involves selecting specific assets or funds that fit the desired allocation and balancing the portfolio to maintain the optimal risk-return tradeoff. The use of algorithms allows robo-advisors to process vast amounts of data, including historical performance, correlations, and volatility, to create portfolios that are statistically optimized for the investor’s goals.

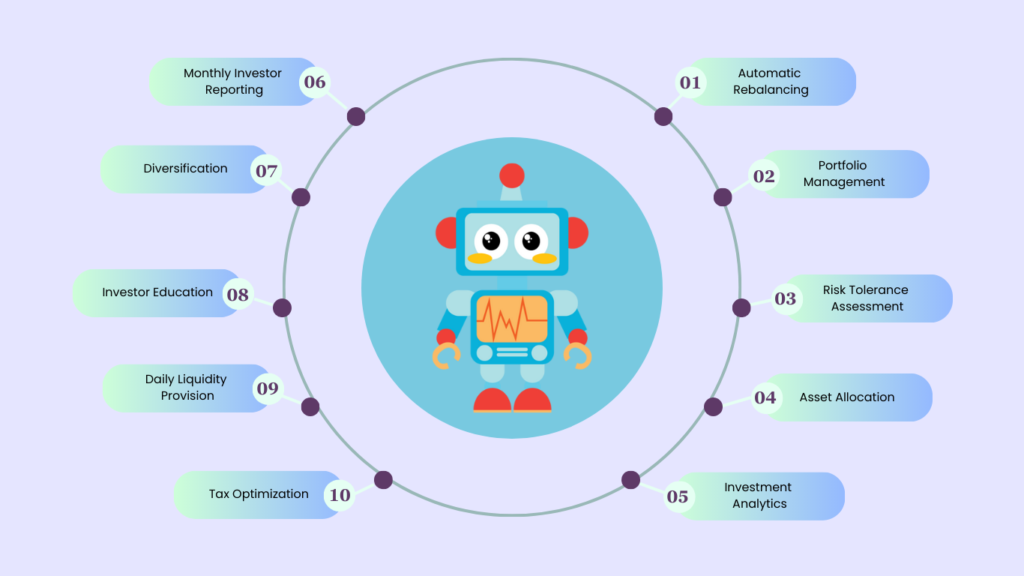

Stalwart Holdings has emerged as a leader in the robo-advisory space by integrating Modern Portfolio Theory with advanced machine learning techniques and academic research. Their platform is designed to offer a highly personalized investment experience by continuously learning from market data and client behavior. Unlike some robo-advisors that rely on static models, Stalwart Holdings’ solution adapts to changing market conditions and individual circumstances, ensuring that portfolios remain aligned with the investor’s goals over time.

The firm’s commitment to academic rigor is evident in their approach to portfolio construction. Stalwart Holdings’ research team collaborates with leading economists and financial theorists to develop models that incorporate the latest insights from behavioral finance, asset pricing, and risk management. This ensures that their robo-advisory platform is not only grounded in proven financial principles but also evolves with new developments in the field. For example, the platform may incorporate factors such as liquidity, market sentiment, and geopolitical risks into its models to enhance portfolio resilience in volatile markets.

Furthermore, Stalwart Holdings’ platform offers a high degree of customization, allowing investors to tailor their portfolios according to specific preferences, such as environmental, social, and governance (ESG) factors. This is increasingly important in a world where more investors are seeking to align their portfolios with their personal values. The platform’s ability to integrate ESG considerations without compromising on the principles of MPT demonstrates the flexibility and sophistication of Stalwart Holdings’ robo-advisory solution.

The success of robo-advisors like Stalwart Holdings underscores a broader shift in the financial industry towards greater reliance on technology and data-driven decision-making. As investors become more comfortable with the idea of entrusting their portfolios to algorithms, the demand for robo-advisory services is likely to continue growing. However, it is essential for investors to recognize that while robo-advisors offer many benefits, they are not a one-size-fits-all solution.

Robo-advisors are best suited for investors who prefer a hands-off approach and are comfortable with the idea of automated portfolio management. While these platforms provide personalized investment strategies, they may not be able to fully address complex financial situations or offer the level of customization that a human advisor might provide. Additionally, robo-advisors typically base their recommendations on historical data and statistical models, which may not always predict future market movements accurately.

Investors should also be aware of the potential limitations of Modern Portfolio Theory. While MPT provides a robust framework for portfolio construction, it is based on several assumptions that may not hold true in all market conditions. For example, MPT assumes that asset returns are normally distributed and that correlations between assets are stable over time. In reality, markets can be unpredictable, and correlations can change rapidly, particularly during periods of market stress.

In conclusion, robo-advisory services represent a significant advancement in the field of investment management, offering a cost-effective, efficient, and personalized approach to portfolio construction. By leveraging Modern Portfolio Theory, platforms like Stalwart Holdings can create diversified and risk-optimized portfolios tailored to individual investor needs. However, it is important to remember that investing always carries risks, and the performance of any portfolio is not guaranteed.

This article is not intended as financial advice, and investors are encouraged to conduct their own research or consult with a regulated financial institution, such as Stalwart Holdings, before making any investment decisions.

Also read, Essential Features to Look for in Affordable Independent Living for Seniors